-

Home Credit được vinh danh tại Global CSR & ESG Awards 2025

Home Credit được vinh danh tại Global CSR & ESG Awards 2025 Thứ năm, 06/03/2025 11:06 Hội nghị và Lễ…

Read More » -

PGBank giữ vững đà tăng trưởng trong Quý I/2025

PGBank giữ vững đà tăng trưởng trong Quý I/2025 Chủ nhật, 20/04/2025 17:31 Quý I/2025, tình hình kinh doanh của…

Read More » -

VNG tăng trưởng lợi nhuận, đẩy mạnh AI, chuyển đổi số

VNG tăng trưởng lợi nhuận, đẩy mạnh AI, chuyển đổi số Thứ ba, 06/05/2025 19:14 Công ty Cổ phần VNG…

Read More » -

Business

Vincom Retail được vinh danh trong top 25 thương hiệu dẫn đầu và Top 50 doanh nghiệp quản trị xuất sắc tại Việt Nam

Vincom Retail lãi sau thuế đạt 3.010 tỷ đồng trong 9 tháng Lợi nhuận sau thuế 9 tháng của Vingroup đạt…

Read More » -

Business

Gần 3.500 hộ dân tại thành phố Hạ Long (Quảng Ninh) hiến đất để nâng cấp hạ tầng đô thị

Theo báo cáo của UBND TP Hạ Long, trong 4 năm qua, thành phố đã phê duyệt 249 dự án…

Read More » -

Business

“Giải mã” năng lực vượt trội của Masterise trên hành trình kiến tạo đô thị bền vững

Masterise lần thứ 4 liên tiếp khẳng định vị thế “Nhà phát triển bất động sản tiêu biểu” Cú đúp…

Read More » -

Giải trí

Tải game FA88 kiếm tiền trực tuyến đổi đời nhanh chóng

Cổng game FA88 luôn được người chơi đánh giá cao về mọi mặt, có thể nói đây là sân chơi hoàn…

Read More » -

Giải trí

IWINCLUB – Trang cá cược trực tuyến uy tín đẳng cấp quốc tế

Nhờ vào sự phát triển của công nghệ, IWINCLUB đã thành công xây dựng trang cá cược trực tuyến đẳng…

Read More » -

Game Bài

Review cổng game 789 CLUB – Địa chỉ cá cược uy tín

Cổng game 789 CLUB được biết đến tới là một trong những địa chỉ chơi cá cược trực tuyến uy…

Read More » -

Game Bài

Game bài miễn phí là gì? Tải trò chơi đánh bài ở đâu tốt?

Nếu bạn đang cần tìm địa chỉ chơi game bài miễn phí mà chưa biết địa chỉ chơi game đánh…

Read More » -

Thể thao

Đánh giá mức độ uy tín của cổng game HITCLUB.WIN

Cổng game HITCLUB.WIN là một địa chỉ cá cược trực tuyến đến từ Châu Âu với chất lượng quốc tế.…

Read More » -

Thể thao

Top các sản phẩm cá cược hấp dẫn có tại nhà cái FC88

Nhà cái FC88 là một trong những địa chỉ cá cược uy tín, được nhiều dân chơi Việt đánh giá…

Read More » -

Thể thao

Tỷ lệ bóng đá kèo nhà cái là gì? Các tỷ lệ kèo bóng đá thông dụng

Khi tham gia vào các hình thức cá cược bóng đá, cược thủ sẽ phải làm quen với rất nhiều…

Read More » -

Thời trang

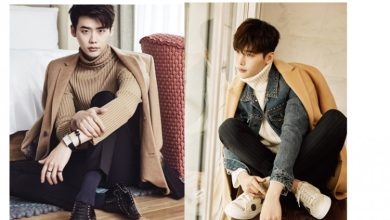

Phối đồ áo len cổ lọ nam vừa giữ ấm, vừa ấn tượng, phong cách!

Phối đồ áo len cổ lọ nam vừa giữ ấm, vừa ấn tượng, phong cách! Phối đồ áo len cổ…

Read More » -

Thời trang

Cách phối đồ với áo len dài nam như thế nào mới đúng chuẩn nhất?

Cách phối đồ với áo len dài nam như thế nào mới đúng chuẩn nhất? Cách phối đồ với áo…

Read More » -

Thời trang

Phối đồ với áo khoác dài nam đơn giản mà ấn tượng! Cần lưu ý điểm gì?

Phối đồ với áo khoác dài nam đơn giản mà ấn tượng! Cần lưu ý điểm gì? Phối đồ với…

Read More » -

Thời trang

Phối đồ với áo khoác jean đen nam phong cách? Tại sao lại không?

Phối đồ với áo khoác jean đen nam phong cách? Tại sao lại không? Phối đồ với áo khoác jean…

Read More » -

Thời trang

Diện áo khoác da nam đẹp, thời trang? Cần lưu tâm yếu tố gì?

Diện áo khoác da nam đẹp, thời trang? Cần lưu tâm yếu tố gì? Đầu tư, mua được trang phục…

Read More » -

Thời trang

Mix đồ với áo khoác da cho nam đơn giản, tinh tế, ấn tượng nhất!

Mix đồ với áo khoác da cho nam đơn giản, tinh tế, ấn tượng nhất! Mix đồ với áo khoác…

Read More » -

Thời trang

Cách phối áo khoác da nam tinh tế đến từ sự “đơn giản”!

Cách phối áo khoác da nam tinh tế đến từ sự “đơn giản”! Cách phối áo khoác da nam tinh tế,…

Read More » -

Thời trang

Cách phối áo phao nam tinh tế, ấn tượng trong ngày đông!

Cách phối áo phao nam tinh tế, ấn tượng trong ngày đông! Cách phối áo phao nam luôn là băn khoăn…

Read More » -

Thời trang

Cách mặc đồ mùa đông cho người thấp giúp cải thiện vóc dáng tối ưu!

Cách mặc đồ mùa đông cho người thấp giúp cải thiện vóc dáng tối ưu! Cách mặc đồ mùa đông…

Read More » -

Thời trang

Phối đồ cho người mập mùa đông dành riêng cho phái mạnh!

Phối đồ cho người mập mùa đông dành riêng cho phái mạnh! Phối đồ cho người mập mùa đông luôn…

Read More » -

Thời trang

Cách mặc áo măng tô nam đẹp, ấn tượng, đậm chất thời thượng!

Cách mặc áo măng tô nam đẹp, ấn tượng, đậm chất thời thượng! Cách mặc áo măng tô nam đẹp…

Read More » -

Thời trang

Áo khoác da phối đồ nam – Phối sao mới đúng chuẩn?

Áo khoác da phối đồ nam – Phối sao mới đúng chuẩn? Áo khoác da phối đồ nam cần lưu…

Read More » -

Thời trang

Cách phối áo len cổ lọ nam ấn tượng! Phối như thế nào mới đúng chuẩn!

Cách phối áo len cổ lọ nam ấn tượng! Phối như thế nào mới đúng chuẩn! Cách phối áo len…

Read More » -

Thời trang

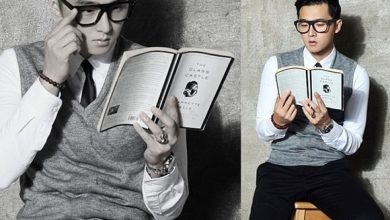

Phối đồ với áo gile len nam sao cho đúng chuẩn? Ấn tượng, nổi bật nhất?

Phối đồ với áo gile len nam sao cho đúng chuẩn? Ấn tượng, nổi bật nhất? Phối đồ với áo…

Read More » -

Thời trang

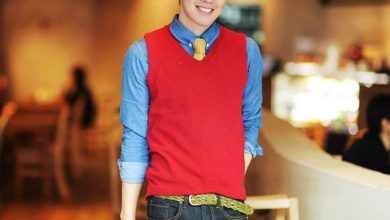

Áo len nam phối cổ sơ mi? Phối sao mới đúng chuẩn, phong cách!

Áo len nam phối cổ sơ mi? Phối sao mới đúng chuẩn, phong cách! Áo len nam phối cổ sơ…

Read More » -

Thời trang

Phối quần jean rách nam đúng chuẩn trong ngày đông!

Phối quần jean rách nam đúng chuẩn trong ngày đông! Phối quần jean rách nam giúp nam giới nổi bật được…

Read More » -

Thời trang

Phối áo sơ mi với áo len nam? Đâu mới đúng chuẩn nhất?

Phối áo sơ mi với áo len nam? Đâu mới đúng chuẩn nhất? Phối áo sơ mi với áo len…

Read More » -

Thời trang

Phối áo khoác với áo sơ mi nam dành riêng cho ngày đông lạnh giá!

Phối áo khoác với áo sơ mi nam dành riêng cho ngày đông lạnh giá! Phối áo khoác với áo…

Read More » -

Thời trang

Cách mix đồ nam mùa đông đơn giản cực đẹp cho phái mạnh

Cách mix đồ nam mùa đông đơn giản cực đẹp cho phái mạnh Cách mix đồ nam mùa đông luôn…

Read More » -

Thời trang

Muốn mặc áo khoác gió đẹp, nam giới cần lưu ý những điều này

Muốn mặc áo khoác gió đẹp, nam giới cần lưu ý những điều này Lựa chọn một chiếc áo khoác…

Read More » -

Thời trang

3 Tip phối áo thun nam không bao giờ lo “lỗi mốt”

3 Tip phối áo thun nam không bao giờ lo “lỗi mốt” 3 Tip phối áo thun nam không bao…

Read More » -

Thời trang

Gợi ý cách mix áo khoác mỏng cho chàng thêm phong cách

Gợi ý cách mix áo khoác mỏng cho chàng thêm phong cách Gợi ý cách mix áo khoác mỏng cho…

Read More » -

Thời trang

Phối áo len cổ lọ nam sao cho đẹp và chuẩn

Phối áo len cổ lọ nam sao cho đẹp và chuẩn Phối áo len cổ lọ nam sao cho đẹp…

Read More » -

Thời trang

Cách chọn áo len dài tay nam chuẩn vóc dáng người

Cách chọn áo len dài tay nam chuẩn vóc dáng người Cách chọn áo len dài tay nam chuẩn vóc…

Read More » -

Thời trang

4 loại áo thu đông nam giới nhất định phải có trong tủ đồ của mình

4 loại áo thu đông nam giới nhất định phải có trong tủ đồ của mình 4 loại áo thu…

Read More » -

Thời trang

Cách chọn áo giữ nhiệt nam đúng chuẩn không phải ai cũng biết

Cách chọn áo giữ nhiệt nam đúng chuẩn không phải ai cũng biết Cách chọn áo giữ nhiệt nam đúng…

Read More » -

Thời trang

Bí quyết mặc áo khoác gió nam đẹp mê mẩn

Bí quyết mặc áo khoác gió nam đẹp mê mẩn Bí quyết mặc áo khoác gió nam đẹp mê mẩn…

Read More » -

Thời trang

3 yếu tố giúp chàng mau chóng tìm ra chiếc áo khoác da ưng ý

3 yếu tố giúp chàng mau chóng tìm ra chiếc áo khoác da ưng ý 3 yếu tố giúp chàng…

Read More » -

Vệ sinh công nghiệp

8 cách diệt rệp giường hiệu quả ngay tại nhà an toàn, hiệu quả

Ngã xuống là kẻ ăn mòn giấc ngủ của bạn, khi chúng nôn, gây cảm giác giác sừng và sự…

Read More » -

Vệ sinh công nghiệp

Nguyên tắc khi vệ sinh bồn cầu bạn cần tuân thủ làm theo

Bạn cần bảo vệ bồn cầu thường xuyên, đặc biệt là khu vực xung quanh bồn cầu. Tuy nhiên, có…

Read More » -

Vệ sinh công nghiệp

6 bước vệ sinh tủ lạnh bằng giấm hiệu quả sạch sẽ trong tích tắc

Điều này có lợi ích bổ sung là làm cho thức ăn trở nên ngon hơn và bạn cũng có…

Read More » -

Vệ sinh công nghiệp

Cách vệ sinh máy giặt cửa trước, ngang đơn giản ngay tại nhà

Bạn không biết cách nào để bảo vệ máy giặt đúng cách? Nếu vậy, bài viết này sẽ cung cấp…

Read More » -

Vệ sinh công nghiệp

3 cách làm sạch ghế sofa vải bằng baking soda tại nhà hiệu quả nhanh chóng

Một trong những kỹ thuật giặt ghế sofa được nhiều người yêu thích và ưa chuộng hiện nay đó là…

Read More » -

Vệ sinh công nghiệp

[Bật mí]: Cách vệ sinh máy rửa bát hiệu quả trong tích tắc

Để đảm bảo hiệu quả và tránh những điều không mong muốn, việc kiểm tra, bảo vệ sinh học và…

Read More » -

Vệ sinh công nghiệp

[Chia sẻ]: 21 loại đèn bắt muỗi diệt côn trùng phổ biến giá rẻ hiện nay

Các loại thuốc đuổi muỗi, tinh dầu và màn chống muỗi thường được sử dụng để xua đuổi và bắt…

Read More » -

Vệ sinh công nghiệp

Top 3 máy hút mùi nhà vệ sinh tốt nhất hiện nay bạn nên dùng

Bạn cần mua một chiếc máy hút mùi để khử mùi và giữ cho không gian nhà vệ sinh được…

Read More » -

Vệ sinh công nghiệp

Hướng dẫn cách lát gạch nền nhà đẹp, đúng kỹ thuật

Để có được một nền gạch đẹp, bền và chất lượng, yếu tố quan trọng là sự kết hợp giữa…

Read More » -

Vệ sinh công nghiệp

Tổng hợp 5 cách đuổi muổi bằng tỏi đơn giản tại nhà

Muỗi xuất hiện liên tục làm tăng nguy cơ mắc bệnh sốt xuất huyết. Thay vì áp dụng các biện…

Read More » -

Vệ sinh công nghiệp

20 cách làm sáng bạc, bạch kim đơn giản, hiệu quả ngay tại nhà

Bạn đang tìm kiếm cách để làm sáng bóng trang sức bạc một cách dễ dàng và hiệu quả chỉ…

Read More » -

Vệ sinh công nghiệp

4 cách vệ sinh gỗ công nghiệp tại nhà đơn giản, hiệu quả

Hiện nay có nhiều cách vệ sinh gỗ công nghiệp đơn giản nhưng đem lại hiệu quả không ngờ. Nếu…

Read More » -

Vệ sinh công nghiệp

Top 10 dịch vụ vệ sinh văn phòng hàng đầu tại TPHCM

Dòng người tập trung đông đúc tại các tòa nhà văn phòng, công sở. Chúng tôi cũng lao động ít…

Read More » -

Vệ sinh công nghiệp

Ý tưởng sáng tạo giúp con vui chơi và các phương bảo vệ bé an toàn

Vì tình hình đại dịch rất mong manh, các bậc cha mẹ rất ngại để con cái của họ tự…

Read More » -

Vệ sinh công nghiệp

12 Cách tái chế quần áo cũ thành vật dụng vô cùng hữu ích

Tủ đồ của bạn đang ngày càng đầy đủ hơn và những bộ quần áo đã trở nên lỗi thời…

Read More » -

Vệ sinh công nghiệp

Bộ vệ sinh laptop gồm những gì? Cách sử dụng bộ vệ sinh laptop

Có một bí quyết để giúp laptop yêu dấu của bạn được hoạt động tốt hơn; đồng thời cũng kéo…

Read More » -

Vệ sinh công nghiệp

[Bật mí]: Cách làm sạch ghế sofa giả da hiệu quả chỉ trong 5 phút

Để tạo nên thành phẩm sofa giả da sử dụng công nghệ phủ nhựa trên bông ép. Giá cả khác…

Read More » -

Vệ sinh công nghiệp

Hướng dẫn vệ sinh điện thoại thông minh hiệu quả nhanh chóng

Nhiều mầm bệnh có thể ẩn trên điện thoại, do đó, điều quan trọng là phải giữ cho điện thoại…

Read More » -

Vệ sinh công nghiệp

Thành phần nước rửa bồn cầu VIM. Cách sử dụng hiệu quả

Tất cả chúng ta đều biết rằng Vim tiêu diệt vi khuẩn gây bệnh đồng thời làm sạch các vết…

Read More » -

Vệ sinh công nghiệp

11 chất tẩy rửa đa năng và 3 ưu điểm khi sử dụng chất tẩy rửa

Làm sạch và loại bỏ tất cả các vết bẩn cứng đầu khỏi bề mặt với chất tẩy rửa đa…

Read More » -

Vệ sinh công nghiệp

[Bật mí]: 7 mẹo để ngôi nhà luôn thơm mát bền lâu và dễ thực hiện

Nhà là nơi chúng ta có thể thư giãn, nghỉ ngơi sau một ngày dài làm việc và học tập.…

Read More » -

Vệ sinh công nghiệp

Hướng dẫn dọn dẹp khay vệ sinh cho mèo và chọn khay đựng cát mèo

Bạn có thể giữ nhà cửa gọn gàng và duy trì sức khỏe cho mèo bằng cách học cách dọn…

Read More » -

Vệ sinh công nghiệp

[Mẹo hay]: Loại bỏ vết sơn, xi măng trên nền gạch đỏ nhanh chóng

Vật liệu phổ biến được sử dụng để lát sân vườn là gạch đỏ. Loại gạch này rất đơn giản…

Read More » -

Vệ sinh công nghiệp

[Chia sẻ]: 10 dụng cụ thông tắc cống bị nghẹt đơn giản và hiệu quả

Đừng lo lắng nếu bạn không biết sử dụng công cụ thông tắc cống nào vì Công ty vệ sinh…

Read More » -

Vệ sinh công nghiệp

Nguyên nhân máy lạnh bị chảy nước và cách khắc phục nhanh chóng

Máy lạnh bị chảy nước liên tục, tình trạng chảy nước ngày nhiều. Và sẽ khiến bạn trở nên lo…

Read More » -

Vệ sinh công nghiệp

7 cách vệ sinh lò vi sóng hiệu quả tăng tuổi thọ cho lò vi sóng

Làm thế nào để vệ sinh lò vi sóng? Nhiều người chỉ làm sạch các vết bẩn trong lò vi…

Read More » -

4 loại nước vệ sinh máy giặt hiệu quả tốt nhất

Sau một thời gian, cặn canxi và hóa chất từ bột giặt sẽ bám vào lồng giặt khiến lồng giặt…

Read More » -

Vệ sinh công nghiệp

[Bật mí]: 3 loại tinh dầu thảo mộc thanh lọc giúp cải thiện không gian sống

Sử dụng tinh dầu thảo mộc thanh lọc không chỉ để loại bỏ vi khuẩn, thanh lọc mà còn để…

Read More » -

Vệ sinh công nghiệp

6 cách vệ sinh ghế sofa giả da công nghiệp tại nhà hiệu quả

Chỉ cần làm theo hướng dẫn vệ sinh ghế sofa giả da công nghiệp tại nhà. Đối với bộ ghế…

Read More » -

Vệ sinh công nghiệp

[Bật mí]: 5 cách giặt gấu bông hiệu quả và nhanh khô

Hướng dẫn cách giặt gấu bông bằng máy giặt trong 20 phút tại nhà. Cách điều chỉnh máy giặt theo…

Read More » -

Vệ sinh công nghiệp

4 cách đuổi muỗi bằng dầu gió vô cùng đơn giản, hiệu quả

Cách đuổi muỗi bằng dầu gió là sử dụng loại tinh dầu phổ biến có nhiều ứng dụng, bao gồm…

Read More » -

Vệ sinh công nghiệp

8 bước khử mùi hôi tủ lạnh nhanh chóng hiệu quả chỉ với 10 phút

Hướng dẫn chi tiết chia thành 8 bước để vệ sinh tủ lạnh thường xuyên để khử mùi hôi tủ…

Read More » -

Vệ sinh công nghiệp

Hướng dẫn giặt giày thể thao tại nhà hiệu quả

Là một người rất hâm mộ giày thể thao, giày vải, giày da, giày chạy bộ, giày sneakers, … Bạn…

Read More » -

Vệ sinh công nghiệp

[Chia sẻ]: 3 Cách giặt thảm bằng baking soda hiệu quả tại nhà

Baking soda là một chất tẩy rửa đa năng, tiết kiệm chi phí, có thể được sử dụng trên hầu…

Read More » -

Vệ sinh công nghiệp

18 cách đuổi muỗi trong phòng ngủ đơn giản và hiệu quả

Hướng dẫn cách đuổi muỗi trong phòng ngủ bằng tinh dầu thơm giúp cho giấc ngủ sâu cũng như cách…

Read More » -

Vệ sinh công nghiệp

Điểm danh 10 dịch vụ vệ sinh laptop chất lượng, uy tín

Chúng tôi đắn đo rất nhiều khi tìm kiếm dịch vụ vệ sinh laptop vì không biết nên chọn dịch…

Read More » -

Vệ sinh công nghiệp

8 bước vệ sinh nệm cực dễ dàng và hiệu quả

Làm cách nào để vệ sinh nệm đúng cách? Gửi đến bạn hướng dẫn và tư vấn vệ sinh đệm…

Read More » -

Vệ sinh công nghiệp

Cách khử mùi phòng kín vô cùng đơn giản, và hiệu quả

Sống trong một căn phòng kín với mùi hôi sẽ gây khó chịu và có thể ảnh hưởng đến sức…

Read More » -

Vệ sinh công nghiệp

Hướng dẫn vệ sinh tai nghe đúng cách phù hợp với từng loại tai nghe

Mẹo chi tiết về cách vệ sinh tai nghe Bluetooth, AirPods và tai nghe điện thoại có dây để bất…

Read More » -

Vệ sinh công nghiệp

Cách vệ sinh cục nóng máy lạnh đơn giản, dễ làm ngay tại nhà

Cục nóng (dàn nóng) là một trong 2 bộ phận quan trọng của máy lạnh, cục nóng thường sẽ được…

Read More » -

Vệ sinh công nghiệp

[TIP]: Diệt rệp bằng baking soda như thế nào hiệu quả

Nếu gián làm bạn sợ hãi và kiến làm bạn khó chịu thì rệp được coi là một loài côn…

Read More » -

Vệ sinh công nghiệp

[Chia sẻ]: 6 loại men xử lý thông tắc bể phốt đơn giản và hiệu quả

Men xử lý thông tắc bể phốt sẽ là lựa chọn hàng đầu của bạn đối với các loại chất…

Read More » -

Vệ sinh công nghiệp

4 bước vệ sinh máy lọc nước tại nhà hiệu quả nhanh chóng

Việc vệ sinh, làm sạch máy lọc nước không phải lúc nào cũng khó như chúng ta vẫn tưởng. Công…

Read More » -

Vệ sinh công nghiệp

[Hướng dẫn]: Cách làm sáng đồ bạc trong nhà hiệu quả, đơn giản

Cách vệ sinh và làm sáng các đồ bạc như thế nào? Chuẩn bị gì để làm sáng đồ bạc?,……

Read More » -

Vệ sinh công nghiệp

[Giải đáp]: Bị bọ chét cắn có nguy hiểm không? Thuốc điều bị bọ chét cắn

Bọ chét cắn có nguy hiểm không? Khi nào cần đi gặp bác sĩ do bọ chét cắn? Đại loại…

Read More » -

Vệ sinh công nghiệp

[Tổng hợp] 5 cách làm sạch đường ống nước trong nhà

Bạn thường xuyên gặp khó khăn trong việc vệ sinh đường ống nước trong nhà? Hãy theo dõi bài viết…

Read More » -

Vệ sinh công nghiệp

[Mẹo hay]: 4 cách khử khuẩn sàn nhà không dư hóa chất mà bạn nên biết

Các thành phần hóa học trong các sản phẩm tẩy rửa gia dụng sẽ hỗ trợ loại bỏ các vi…

Read More » -

Vệ sinh công nghiệp

Hướng dẫn khử trùng cốc nguyệt san đúng cách an toàn tuyệt đối

Sử dụng cốc nguyệt san là một cách tuyệt vời để bảo vệ môi trường. một sự thay thế thiết…

Read More » -

Vệ sinh công nghiệp

[Chia sẻ]: Cách lau kính bằng cây gạt kính hiệu quả và đơn giản tại nhà

Bạn cảm thấy phiền vì những vết bẩn trên kính cửa sổ? Bạn đã bao giờ phải mất nhiều thời…

Read More » -

Vệ sinh công nghiệp

[Chia sẻ]: 12 cách tẩy mực trên đồ nhựa đơn giản tại nhà

Bất cứ đồ nhựa nào dính mực cũng không gây ảnh hưởng để sức khỏe con người nhưng lại giảm…

Read More » -

Thể thao

Soi kèo phạt góc Lille OSC vs Fenerbahce, 1h30 ngày 07/08

Kqbd.mobi soi kèo phạt góc Lille OSC vs Fenerbahce, 1h30 ngày 07/08 – Champions League. Soi kèo châu Á, Tài…

Read More » -

Thể thao

Soi kèo phạt góc Red Bull Salzburg vs FC Twente, 1h45 ngày 07/08

Kqbd.mobi soi kèo phạt góc Red Bull Salzburg vs FC Twente, 1h45 ngày 07/08 – Champions League. Soi kèo châu…

Read More » -

Thể thao

Nhận định Qarabag vs Ludogorets Razgrad, 23h00 ngày 6/8

Nhận định Qarabag vs Ludogorets Razgrad, dự đoán bóng đá Cúp C1 châu Âu hôm nay 23h00 ngày 6/8 chính…

Read More » -

Thể thao

Nhận định Malmo FF vs PAOK Saloniki, 0h00 ngày 7/8

Nhận định Malmo FF vs PAOK Saloniki, dự đoán bóng đá Cúp C1 Châu Âu hôm nay 0h00 ngày 7/8…

Read More » -

Thể thao

Nhận định Midtjylland vs Ferencvarosi, 00h15 ngày 7/8

Nhận định Midtjylland vs Ferencvarosi, dự đoán bóng đá Cúp C1 Châu Âu hôm nay 00h15 ngày 7/8 chính xác.…

Read More » -

Thể thao

Nhận định Dynamo Kyiv vs Rangers, 01h00 ngày 7/8

Nhận định Dynamo Kyiv vs Rangers, dự đoán bóng đá Cúp C1 Châu Âu hôm nay 01h00 ngày 7/8 chính…

Read More » -

Thể thao

Nhận định Sparta Prague vs Steaua Bucuresti, 01h00 ngày 7/8

Nhận định Sparta Prague vs Steaua Bucuresti, dự đoán bóng đá Cúp C1 Châu Âu hôm nay 01h00 ngày 7/8…

Read More » -

Thể thao

Nhận định Lille vs Fenerbahce, 01h00 ngày 7/8

Nhận định Lille vs Fenerbahce, dự đoán bóng đá Cúp C1 Châu Âu hôm nay 01h00 ngày 7/8 chính xác.…

Read More » -

Thể thao

Nhận định Red Bull Salzburg vs FC Twente, 1h45 ngày 7/8

Nhận định Red Bull Salzburg vs FC Twente, dự đoán Vòng loại III Cúp C1 châu Âu hôm nay 1h45…

Read More » -

Thể thao

Soi kèo phạt góc Jagiellonia Bialystok vs Bodo Glimt, 1h45 ngày 08/08

Kqbd.mobi soi kèo phạt góc Jagiellonia Bialystok vs Bodo Glimt, 1h45 ngày 08/08 – Champions League. Soi kèo châu Á,…

Read More » -

Thể thao

Soi kèo phạt góc Slavia Praha vs St. Gilloise, 0h ngày 08/08

Kqbd.mobi soi kèo phạt góc Slavia Praha vs St. Gilloise, 0h ngày 08/08 – Champions League. Soi kèo châu Á,…

Read More » -

Thể thao

Soi kèo phạt góc Slovan Bratislava vs APOEL Nicosia, 1h30 ngày 08/08

Kqbd.mobi soi kèo phạt góc Slovan Bratislava vs APOEL Nicosia, 1h30 ngày 08/08 – Champions League. Soi kèo châu Á,…

Read More » -

Nhận định Jagiellonia Bialystok vs Bodo Glimt, 1h45 ngày 08/08

Nhận định Jagiellonia Bialystok vs Bodo Glimt, dự đoán bóng đá Champions League hôm nay 1h45 ngày 08/08 chính xác.…

Read More » -

Nhận định Slovan Bratislava vs APOEL Nicosia, 1h30 ngày 8/8

Nhận định Slovan Bratislava vs APOEL Nicosia, dự đoán bóng đá Cúp C1 châu Âu hôm nay 1h30 ngày 8/8…

Read More » -

Thể thao

Nhận định Slavia Praha vs St. Gilloise, 0h00 ngày 8/8

Nhận định Slavia Praha vs St. Gilloise, dự đoán Vòng loại III Cúp C1 châu Âu hôm nay 0h00 ngày…

Read More » -

Thể thao

Soi kèo phạt góc FC Twente Enschede vs Red Bull Salzburg, 0h ngày 14/08

Kqbd.mobi soi kèo phạt góc FC Twente Enschede vs Red Bull Salzburg, 0h ngày 14/08 – Champions League. Soi kèo…

Read More » -

Thể thao

Soi kèo phạt góc Fenerbahce vs Lille OSC, 0h ngày 14/08

Kqbd.mobi soi kèo phạt góc Fenerbahce vs Lille OSC, 0h ngày 14/08 – Champions League. Soi kèo châu Á, Tài…

Read More » -

Thể thao

Soi kèo phạt góc APOEL Nicosia vs Slovan Bratislava, 0h ngày 14/08

Kqbd.mobi soi kèo phạt góc APOEL Nicosia vs Slovan Bratislava, 0h ngày 14/08 – Champions League. Soi kèo châu Á,…

Read More » -

Thể thao

Soi kèo phạt góc Bodo Glimt vs Jagiellonia Bialystok, 0h ngày 14/08

Kqbd.mobi soi kèo phạt góc Bodo Glimt vs Jagiellonia Bialystok, 0h ngày 14/08 – Champions League. Soi kèo châu Á,…

Read More » -

Thể thao

Soi kèo phạt góc PAOK Saloniki vs Malmo FF, 0h30 ngày 14/08

Kqbd.mobi soi kèo phạt góc PAOK Saloniki vs Malmo FF, 0h30 ngày 14/08 – Champions League. Soi kèo châu Á,…

Read More » -

Business

Soi kèo phạt góc Glasgow Rangers vs Dynamo Kyiv, 1h45 ngày 14/08

Kqbd.mobi soi kèo phạt góc Glasgow Rangers vs Dynamo Kyiv, 1h45 ngày 14/08 – Champions League. Soi kèo châu Á,…

Read More » -

Business

Nhận định FC Twente Enschede vs Red Bull Salzburg, 0h00 ngày 14/8

Nhận định FC Twente Enschede vs Red Bull Salzburg, dự đoán bóng đá Cúp C1 Châu Âu hôm nay 0h00…

Read More » -

Business

Nhận định Fenerbahce vs Lille, 00h00 ngày 14/8

Nhận định Fenerbahce vs Lille, dự đoán bóng đá Cúp C1 Châu Âu hôm nay 00h00 ngày 14/8 chính xác.…

Read More » -

Business

Nhận định APOEL Nicosia vs Slovan Bratislava, 00h00 ngày 14/8

Nhận định APOEL Nicosia vs Slovan Bratislava, dự đoán bóng đá Cúp C1 Châu Âu hôm nay 00h00 ngày 14/8…

Read More » -

Business

Nhận định Bodo Glimt vs Jagiellonia Bialystok, 00h00 ngày 14/8

Nhận định Bodo Glimt vs Jagiellonia Bialystok, dự đoán bóng đá Cúp C1 Châu Âu hôm nay 00h00 ngày 14/8…

Read More » -

Business

Nhận định PAOK vs Malmo, 00h30 ngày 14/8

Nhận định PAOK vs Malmo, dự đoán bóng đá Cúp C1 Châu Âu hôm nay 00h30 ngày 14/8 chính xác.…

Read More » -

Business

Nhận định Ludogorets Razgrad vs Qarabag, 1h00 ngày 14/8

Nhận định Ludogorets Razgrad vs Qarabag, dự đoán Vòng loại III Cúp C1 châu Âu hôm nay 1h00 ngày 14/8/2024…

Read More » -

Business

Nhận định Ferencvarosi TC vs Midtjylland, 1h00 ngày 14/8

Nhận định Ferencvarosi TC vs Midtjylland, dự đoán Vòng loại III Cúp C1 châu Âu hôm nay 1h00 ngày 14/8/2024…

Read More » -

Business

Nhận định Glasgow Rangers vs Dynamo Kyiv, 1h45 ngày 14/8

Nhận định Glasgow Rangers vs Dynamo Kyiv, dự đoán bóng đá Cúp C1 châu Âu hôm nay 1h45 ngày 14/8…

Read More » -

Business

Nhận định St. Gilloise vs Slavia Praha, 1h30 ngày 14/8

Nhận định St. Gilloise vs Slavia Praha, dự đoán Vòng loại III Cúp C1 châu Âu hôm nay 1h30 ngày…

Read More » -

Business

Nhận định FC Steaua Bucuresti vs Sparta Prague, 1h30 ngày 14/8

Nhận định FC Steaua Bucuresti vs Sparta Prague, dự đoán Vòng loại III Cúp C1 châu Âu hôm nay 1h30…

Read More » -

Business

Nhận định Bodo Glimt vs Crvena Zvezda, 02h00 ngày 21/8

Nhận định Bodo Glimt vs Crvena Zvezda, dự đoán bóng đá cúp C1 châu Âu hôm nay 02h00 ngày 21/8…

Read More » -

Business

Nhận định Dinamo Zagreb vs Qarabag, 02h00 ngày 21/8

Nhận định Dinamo Zagreb vs Qarabag, dự đoán bóng đá cúp C1 châu Âu hôm nay 02h00 ngày 21/8 chính…

Read More » -

Business

Nhận định Lille vs Slavia Praha, 02h00 ngày 21/8

Nhận định Lille vs Slavia Praha, dự đoán bóng đá cúp C1 châu Âu hôm nay 02h00 ngày 21/8 chính…

Read More » -

Business

Soi kèo phạt góc Lille OSC vs Slavia Praha, 2h ngày 21/08

Kqbd.mobi soi kèo phạt góc Lille OSC vs Slavia Praha, 2h ngày 21/08 – Champions League. Soi kèo châu Á,…

Read More » -

Business

Soi kèo phạt góc Bodo Glimt vs Crvena Zvezda, 2h ngày 21/08

Kqbd.mobi soi kèo phạt góc Bodo Glimt vs Crvena Zvezda, 2h ngày 21/08 – Champions League. Soi kèo châu Á,…

Read More » -

Business

Soi kèo phạt góc Dinamo Zagreb vs Qarabag, 2h ngày 21/08

Kqbd.mobi soi kèo phạt góc Dinamo Zagreb vs Qarabag, 2h ngày 21/08 – Champions League. Soi kèo châu Á, Tài…

Read More » -

Business

Soi kèo phạt góc Young Boys vs Galatasaray, 2h ngày 22/08

Kqbd.mobi soi kèo phạt góc Young Boys vs Galatasaray, 2h ngày 22/08 – Champions League. Soi kèo châu Á, Tài…

Read More » -

Business

Soi kèo phạt góc Dynamo Kyiv vs Red Bull Salzburg, 2h ngày 22/08

Kqbd.mobi soi kèo phạt góc Dynamo Kyiv vs Red Bull Salzburg, 2h ngày 22/08 – Champions League. Soi kèo châu…

Read More » -

Business

Soi kèo phạt góc Malmo FF vs Sparta Prague, 2h ngày 22/08

Kqbd.mobi soi kèo phạt góc Malmo FF vs Sparta Prague, 2h ngày 22/08 – Champions League. Soi kèo châu Á,…

Read More » -

Business

Nhận định Midtjylland vs Slovan Bratislava, 2h ngày 22/8

Nhận định Midtjylland vs Slovan Bratislava, dự đoán bóng đá Cúp C1 châu Âu hôm nay 2h ngày 22/8 chính…

Read More » -

Business

Nhận định Young Boys vs Galatasaray, 2h00 ngày 22/8

Nhận định Young Boys vs Galatasaray, dự đoán Cúp C1 châu Âu hôm nay 2h00 ngày 22/8/2024 chính xác. Nhận…

Read More » -

Nhận định Dynamo Kyiv vs Red Bull Salzburg, 2h00 ngày 22/8

Nhận định Dynamo Kyiv vs Red Bull Salzburg, dự đoán Cúp C1 châu Âu hôm nay 2h00 ngày 22/8/2024 chính…

Read More » -

Business

Soi kèo phạt góc Midtjylland vs Slovan Bratislava, 2h ngày 22/08

Kqbd.mobi soi kèo phạt góc Midtjylland vs Slovan Bratislava, 2h ngày 22/08 – Champions League. Soi kèo châu Á, Tài…

Read More » -

Business

Nhận định Malmo FF vs Sparta Prague, 2h00 ngày 22/8

Nhận định Malmo FF vs Sparta Prague, dự đoán Cúp C1 châu Âu hôm nay 2h00 ngày 22/8/2024 chính xác.…

Read More » -

Business

Nhận định Red Bull Salzburg vs Dynamo Kyiv, 2h ngày 28/08

Nhận định Red Bull Salzburg vs Dynamo Kyiv, dự đoán bóng đá Champions League hôm nay 2h ngày 28/08 chính…

Read More » -

Business

Nhận định Sparta Prague vs Malmo FF, 2h ngày 28/08

Nhận định Sparta Prague vs Malmo FF, dự đoán bóng đá Champions League hôm nay 2h ngày 28/08 chính xác.…

Read More » -

Business

Soi kèo phạt góc Galatasaray vs Young Boys, 2h ngày 28/08

Kqbd.mobi soi kèo phạt góc Galatasaray vs Young Boys, 2h ngày 28/08 – Champions League. Soi kèo châu Á, Tài…

Read More » -

Business

Soi kèo phạt góc Red Bull Salzburg vs Dynamo Kyiv, 2h ngày 28/08

Kqbd.mobi soi kèo phạt góc Red Bull Salzburg vs Dynamo Kyiv, 2h ngày 28/08 – Champions League. Soi kèo châu…

Read More » -

Business

Nhận định Galatasaray vs Young Boys, 2h ngày 28/8

Nhận định Galatasaray vs Young Boys, dự đoán bóng đá Cúp C1 châu Âu hôm nay 2h ngày 28/8 chính…

Read More » -

Business

Soi kèo phạt góc Sparta Prague vs Malmo FF, 2h ngày 28/08

Kqbd.mobi soi kèo phạt góc Sparta Prague vs Malmo FF, 2h ngày 28/08 – Champions League. Soi kèo châu Á,…

Read More » -

Business

Soi kèo phạt góc Qarabag vs Dinamo Zagreb, 23h45 ngày 28/08

Kqbd.mobi soi kèo phạt góc Qarabag vs Dinamo Zagreb, 23h45 ngày 28/08 – Champions League. Soi kèo châu Á, Tài…

Read More » -

Business

Nhận định Qarabag vs Dinamo Zagreb, 23h45 ngày 28/8

Nhận định Qarabag vs Dinamo Zagreb, dự đoán bóng đá cúp C1 châu Âu hôm nay 23h45 ngày 28/8 chính…

Read More » -

Business

Soi kèo phạt góc Crvena Zvezda vs Bodo Glimt, 2h ngày 29/08

Kqbd.mobi soi kèo phạt góc Crvena Zvezda vs Bodo Glimt, 2h ngày 29/08 – Champions League. Soi kèo châu Á,…

Read More » -

Business

Nhận định Crvena Zvezda vs Bodo Glimt, 2h ngày 29/8

Nhận định Crvena Zvezda vs Bodo Glimt, dự đoán bóng đá Cúp C1 châu Âu hôm nay 2h ngày 29/8…

Read More » -

Business

Nhận định Slavia Praha vs Lille, 2h ngày 29/8

Nhận định Slavia Praha vs Lille, dự đoán bóng đá Cúp C1 châu Âu hôm nay 2h ngày 29/8 chính…

Read More » -

Business

Nhận định Slovan Bratislava vs Midtjylland, 2h ngày 29/8

Nhận định Slovan Bratislava vs Midtjylland, dự đoán bóng đá Cúp C1 châu Âu hôm nay 2h ngày 29/8 chính…

Read More » -

Business

Soi kèo phạt góc Slavia Praha vs Lille OSC, 2h ngày 29/08

Kqbd.mobi soi kèo phạt góc Slavia Praha vs Lille OSC, 2h ngày 29/08 – Champions League. Soi kèo châu Á,…

Read More » -

Business

Soi kèo phạt góc Slovan Bratislava vs Midtjylland, 2h ngày 29/08

Kqbd.mobi soi kèo phạt góc Slovan Bratislava vs Midtjylland, 2h ngày 29/08 – Champions League. Soi kèo châu Á, Tài…

Read More » -

Business

Nhận định, Soi kèo Juventus vs PSV Eindhoven, 23h45 ngày 17/9

Nhận định, Soi kèo Juventus vs PSV Eindhoven, dự đoán giải Cúp C1 châu Âu hôm nay 23h45 ngày 17/9/2024…

Read More »